ECONOMIC BACKGROUND

Interest rates have remained steady during the 2017–18 financial year with the Reserve Bank of Australia last cutting the benchmark interest rate by 25 basis points to 1.5 per cent in August 2016. This has enabled IBA to maintain the same commencing interest rate offered to first home buyers as last year, depending upon their income. The significant increase in home loans provided in comparison to that budgeted has materially increased IBA’s fair value discount expense, though this has been offset somewhat by higher than budgeted loan repayments and discharges.

Whilst interest rates have remained stable, credit conditions continue to tighten, including as a result of the Royal Commission into Misconduct in the Banking and Financial Services industry. As borrowing from main lenders becomes challenging, this creates increasing demand on IBA’s solutions. However, our resources and capital are finite, meaning IBA will need to access new funding solutions to keep pace with growing demand.

The value of IBA’s investment portfolio has increased following the strong performance of the IPF and the increase of property values in the I-REIT. The value of the portfolio has further benefited from increases in the value of the tourism and retail portfolios.

FINANCIAL RESULTS

The financial statements are presented on a consolidated basis with its subsidiaries which operate businesses spread across tourism, mining, services, renewables, retail, and investment property.

The 2017– 18 cash operating surplus was $79.4m against $59.1m for the previous year. The consolidated operating surplus for IBA is $12.8 million against the previous year’s operating surplus of $38.4 million. The difference is mostly attributed to a non-cash item - the increased fair value discount expense associated with IBA’s home loan portfolio which provided significantly more home loans this year than in previous years.

Total income has increased from $210.2 million last financial year to $218.2 million due to increased grant revenue offset by non-recurring gains made last year, which also impacted goods and services income, through the disposal of subsidiaries in the previous and current financial year.

Total expenses increased from $171.6 million last year to $205.5 million due mostly to material increase in fair value discount expense on the home loan portfolio caused by the significant increase in home loans provided, as well as a decrease in supplier expenditure resulting from disposal of subsidiaries in the previous and current financial year.

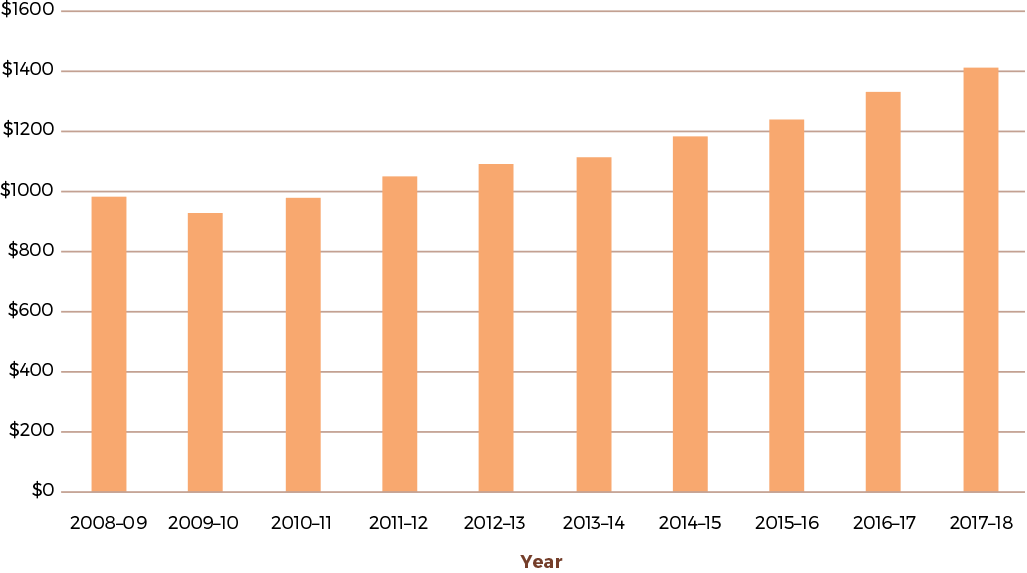

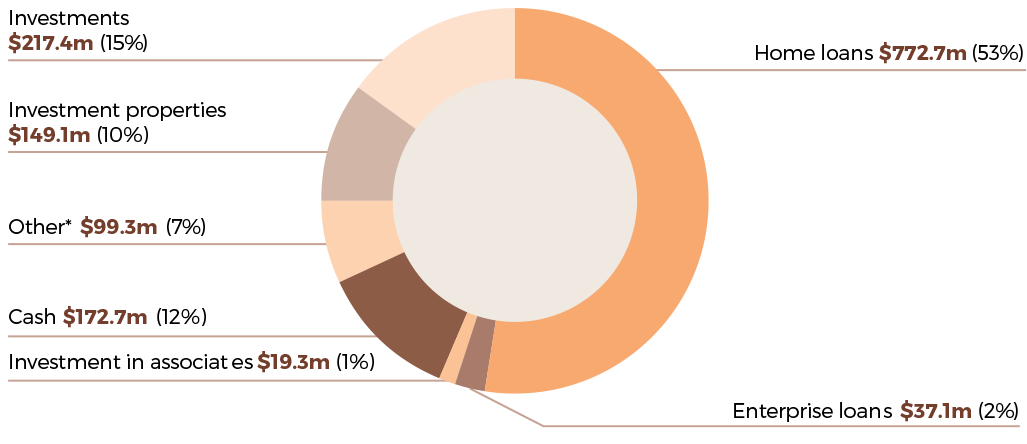

IBA’s total consolidated assets as at 30 June 2018 are $1.5 billion, an increase of $89 million over the previous year, primarily due to an increase in the home loan portfolio and value of investment properties held. IBA’s net assets of $1.4 billion are $81 million higher than last year, driven by equity appropriation from government and increased equity contribution from Indigenous groups.

FIGURE 14: NET ASSET GROWTH

FIGURE 15: CONSOLIDATED TOTAL ASSETS

* includes additional business finance products such as performance bonds, invoice finance and asset leasing.

FUNDING

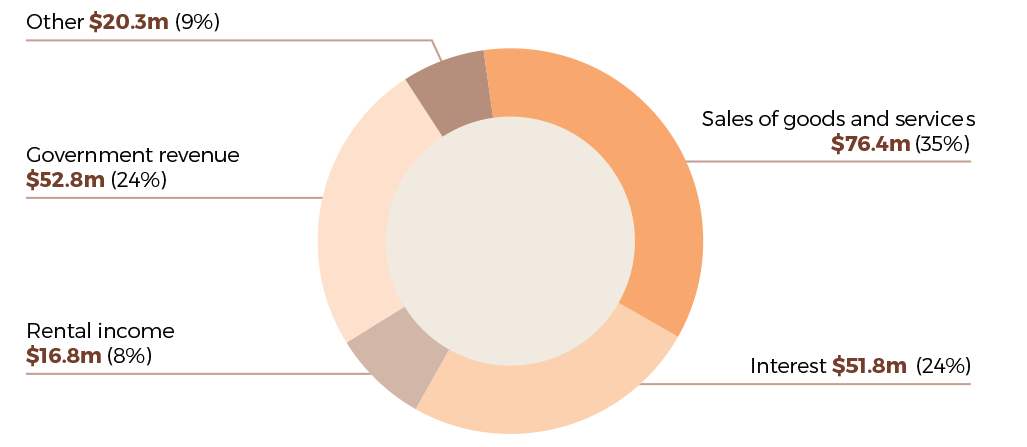

The income base of the consolidated IBA group comprises both grant and appropriation revenue from the Commonwealth as well as self-generated revenue.

In 2017–18, IBA received $40.6 million in grant receipts, $10.1 million by way of appropriation, and $163.2 million in self-generated revenue. The self-generated revenue consists mostly of interest earnings from the loan portfolio, rental receipts from investment properties, and goods and services income from subsidiaries.

IBA also received $22.9 million by way of equity injection from the Commonwealth for use in providing home loans.

LEGAL AND FINANCIAL FRAMEWORK

IBA’s financial statements must be read in the context of its enabling legislation, the Aboriginal and Torres Strait Islander Act, and the impact of Australian Accounting Standards, particularly in respect to the valuation of its financial assets.

The Aboriginal and Torres Strait Islander Act requires that funds available under the New Housing Fund including interest earnings, are to be used exclusively for housing loans. Consequently, income earned from the New Housing Fund is not available for operational expenses but rather utilised for new home loans under that Fund. The financial statements for the New Housing Fund are provided separately under Note 17.

Australian Accounting Standards require that the financial assets of IBA be recorded at their fair value. Loans in relation to the housing and business loans portfolio are

issued at concessional interest rates. A market valuation requires discounting the portfolio value to equate interest earned to market yield for comparable risk. The annual incremental discount is a non-cash expenditure item, recorded in the Statement of Comprehensive Income under write-down and impairment of assets.

For the investment portfolio, valuation at fair market value results in cyclical movements in property and business valuations being recorded in the Statement of Comprehensive Income.

OUTLOOK

Demand for IBA’s solutions continues to grow. In 2017–18, IBA was able to utilise its reserves to meet increase demand beyond its government funding, resulting in a net cash outflow of $105m. However, as a predominantly self-funded agency, IBA’s resources and capital are finite. New sources of funding and innovative funding solutions are required to sustain increased performance and keep pace with demand. Any volatility in economic conditions including interest rates, would impact IBA’s asset valuations and operating results.

We will continue to invest in cost-effective information management systems to improve our customer support activities and document management systems. There will be a strong focus on reducing the cost of services that support the Housing Solutions, Business Solutions and Investment and Asset Management Programs.

IBA’s net asset base is expected to continue its steady growth during 2018–19, with total assets budgeted at $1.5 billion as at 30 June 2019. Total consolidated revenue is budgeted to be $201.2 million including grant receipts of $30.2 million and appropriations of $9.8 million.

FIGURE 16: CONSOLIDATED INCOME